Introduction

Did you know that 82% of small businesses fail due to cash flow problems? That’s a sobering statistic—but it’s also a wake-up call. Let’s rewind to the story of Ada, a first-time founder who launched her tech startup with great ambition but no financial roadmap. Within months, expenses outpaced revenue, and she found herself scrambling for funding and clarity. Her journey is not uncommon.

Launching a startup is exciting, but it can quickly become overwhelming without a financial plan. Many founders focus on product development and customer acquisition, but overlook the backbone of every successful business—financial planning. In this blog post, we’ll explore why a financial plan is not just a “nice-to-have,” but an essential tool from day one.

What is a Financial Plan?

A financial plan is a comprehensive roadmap for your business finances. It includes projections for revenue, expenses, cash flow, and profitability. It also outlines financial goals, strategies to reach them, and tools to monitor progress.

Key Elements of a Financial Plan:

- Revenue forecasts

- Expense budgets

- Cash flow projections

- Break-even analysis

- Capital requirements

- Profit margins

Why Financial Planning is Crucial from the Start

- Prevents Overspending: Without a plan, startups often underestimate expenses and burn through capital too quickly.

- Helps You Raise Capital: Investors and lenders want to see a solid financial plan that shows you’re thinking long-term.

- Supports Better Decision-Making: Knowing your numbers helps you decide when to hire, scale, or pivot.

- Identifies Risk Early: Spot potential shortfalls before they become business-ending problems.

- Provides Accountability: A plan gives founders and teams financial KPIs to work toward.

Real-Life Consequences of Poor Planning

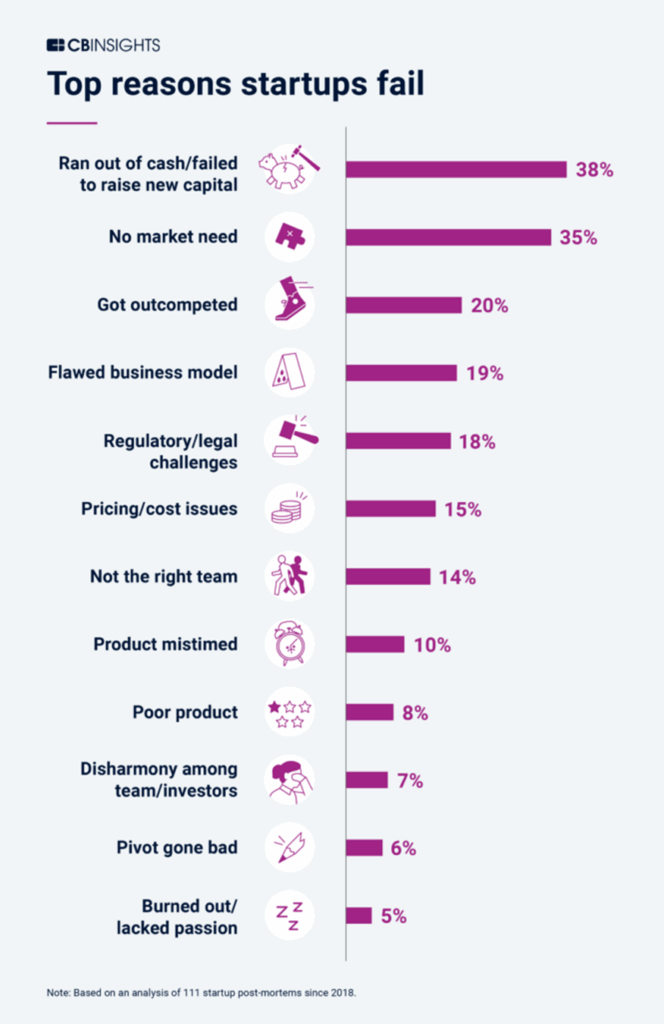

Almost 40% of startups fail due to financial mismanagement or lack of planning. A CB Insights study identified the top 12 reasons startups fail, and financial mismanagement is at the heart of it. Here’s a visual representation of the top failure reasons:

Source: CB Insights – Top 12 Reasons Startups Fail

For example, a startup that launched a product without forecasting customer acquisition costs ran out of cash in 6 months. With a financial plan, they would’ve seen the red flags early and adjusted their strategy.

How to Create Your Financial Plan

Step-by-step guide:

- Define your startup costs. Include development, legal, tools, and marketing.

- Estimate your revenue model. Subscription? One-time fees? Include pricing tiers.

- Build your budget. Account for recurring and one-time expenses.

- Forecast cash flow. Use monthly projections.

- Set financial goals. Revenue targets, profitability timeline, and investor milestones.

- Use tools. SmartSheet, QuickBooks, Google Sheets, or financial planning software.

Check out our infographics “5 Reasons Why every startup needs a financial plan”

Tools and Templates for Startups

Every startup, no matter how lean or agile, needs the right tools to keep its financial house in order. Luckily, you don’t need a big budget to access powerful resources that can help streamline planning, track expenses, and stay compliant. Below is a curated list of free and paid tools and templates to help you lay a solid financial foundation from day one.

| S/N | Template | Purpose | Format |

| 1. | Google Sheets Financial Model Template | Track revenue, costs, and runway | Google Sheets/Excel |

| 2. | Cash Flow Forecast Template | Visualize monthly inflow/outflow | Google Sheets/Excel |

| 3. | P&L Statement Template | Monitor profitability | Google Sheets/Excel |

| 4. | Break-even Calculator | Identify when you’ll become profitable | Online Tool |

Pro Tip: Use conditional formatting in Sheets to highlight overspending and revenue dips.

Recommended Tools for Financial Planning

- QuickBooks (Best for Bookkeeping)

Helps you track income, expenses, invoicing, payroll, and taxes—all in one place. - Xero (Best for Small Business Budgeting)

Cloud-based accounting platform with beautiful dashboards and seamless bank integrations. - LivePlan (Best for Business Planning)

Create professional business plans with financial forecasting and pitch decks. - Wave (Best Free Accounting Tool)

Includes invoicing, receipt scanning, and reports—100% free for startups on a budget. - Airtable (Best for Tracking Milestones and KPIs)

Part spreadsheet, part database—great for organizing launch plans, goal tracking, and operations.

Tools We Use at Smart Scale

At Smart Scale, we combine the best and affordable industry tools with custom templates and automation systems to help startups:

- Build financial forecasts

- Automate reporting

- Monitor key financial metrics in real-time

Our Toolkit Includes:

- Notion Dashboards (for weekly reports)

- Zapier (to automate invoice reminders)

- Canva (for visual reports and investor decks)

- Google Data Studio (for real-time analytics)

Want access to our Smart Scale Template Pack? Request it here.

When to Revisit Your Plan

Revisit your financial plan at key milestones:

- Quarterly Reviews: Analyze performance and adjust forecasts every quarter.

- After a Funding Round: Update your financial goals, hiring plan, and allocation strategy.

- When Scaling: Planning to expand to new markets or launch new products? Update costs, projections, and risks.

- When Hitting or Missing a Milestone: Whether you exceed expectations or fall short, adjust your plan

- Changes in Market or Regulation: Stay responsive to economic shifts, regulatory changes, or new industry standards.

How Smart Scale Solutions Can Help

We help startups and small businesses build and manage custom financial plans with automation, dashboards, and expert insights.

Conclusion

Startups don’t fail because they lack passion; they fail because they lack planning. A solid financial plan is your guide, your safety net, and your strategy rolled into one. Don’t wait. Build yours today.

Ready to build a financial plan that grows with your business? Book a free consultation today!